Trust Bank Launches In-App Travel Insurance

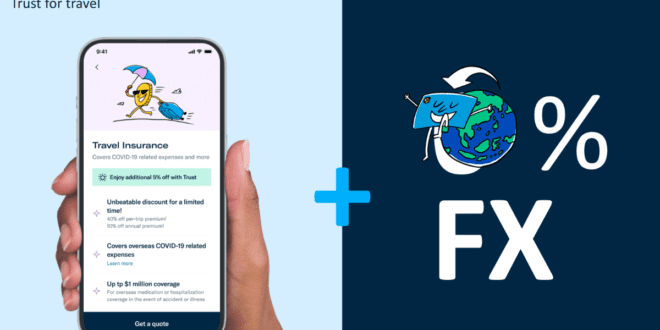

Trust Bank, a joint venture between Standard Chartered and FairPrice Group, has announced that its customers can now directly purchase travel insurance offered by NTUC Income via the Trust mobile app. Trust Bank has acquired 500,000 customers in just seven months and has deposits balances of over S$1 billion. CEO Dwaipayan Sadhu stated that the company wants to become the fourth-largest retail bank in Singapore by the end of next year and to break even in 2025. The digital bank has been rolling out new features since the start of 2023 to achieve this, and the in-app NTUC Income travel insurance experience is the latest addition to this suite of products and services.

Trust Bank’s Continuous Expansion

Trust Bank has a zero markup on all overseas expenses, unlike most credit cards in the market that charge up to 3.5 per cent fee on every overseas transaction. The travel insurance experience added to the mobile app requires less than 60 seconds to apply for and is devoid of any data entry, which enhances the overall customer experience and positions Trust as a comprehensive one-stop-shop for travel. Trust will soon offer instant loans and unsecured loans to customers in the coming months, with additional services like pay by trial, savings pots, and other in-app features expected to be available by the end of the year.

Likewise, many of the services, such as travel insurance, were initially offered by Trust via a tap-out to the NTUC Income website, but due to a high level of adoption, Trust decided to build some of these services within its mobile app. CEO Dwaipayan Sadhu stated that the launch of Trust credit card nine months ago provided Trust Bank with access to data on customer behavior and their repayment capability. This allows the digital bank to assess interest rates and customers’ eligibility in crafting more personalized offers such as instant loans.

Trust Bank’s Growth

CEO Dwaipayan Sadhu also acknowledged that Singapore’s digital infrastructure and the high level of digital adoption has turned the country into a very attractive digital banking space. Trust Bank is backed by Standard Chartered, which has a long banking heritage in Singapore and a full banking licence. In addition, the NTUC ecosystem brings strong customer advocacy and loyalty, making it natural for Trust to continue to roll out more services that are “built on customers’ needs”.

As Singapore’s fastest-growing digital bank, Trust Bank has become one of the fastest-growing digital banks since its inception in September 2022. Trust Bank hopes to become the fourth-largest retail bank in Singapore by the end of next year and to break even in 2025. The company will continue to build services based on customers’ needs to achieve its objectives.

Mind Uncharted Explore. Discover. Learn.

Mind Uncharted Explore. Discover. Learn.