Coinbase to Suspend Trading of Tether, DAI, and RAI Stablecoins for Canadian Users

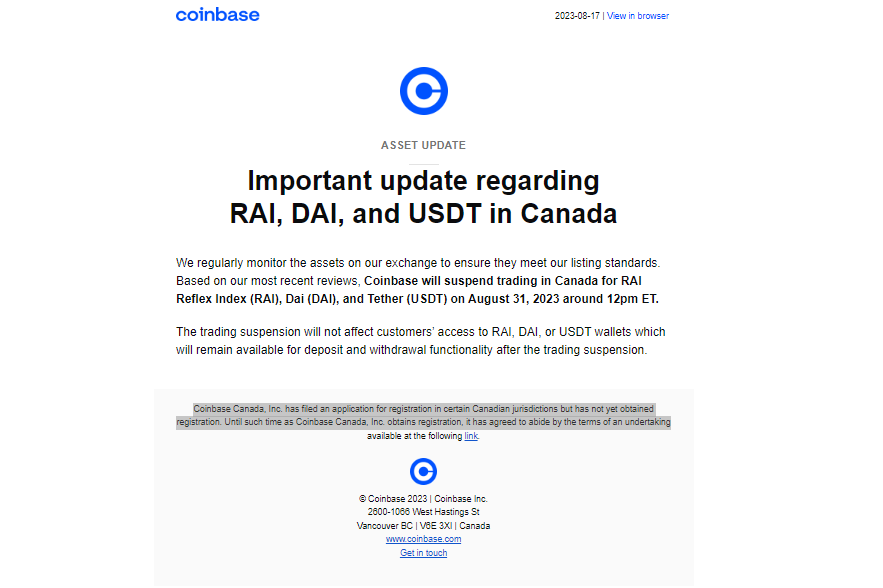

Cryptocurrency exchange Coinbase has announced that it will suspend trading of Tether (USDT), DAI, and RAI stablecoins for Canadian users starting from August 31. This decision comes after Coinbase conducted a review of the assets on its exchange to ensure they meet its listing standards.

In an email notice sent to users on August 17, Coinbase stated that the trading of the mentioned stablecoins will no longer be available for Canadian users beginning in September. However, users will still be able to deposit and withdraw these stablecoins even after the suspension of trading.

In a statement, Coinbase Canada, Inc. mentioned its ongoing registration process in certain Canadian jurisdictions. Until the registration is obtained, the company has agreed to abide by certain terms and conditions. The exact details of these terms and conditions were not provided in the notice.

Regulatory Background and Impact

This move by Coinbase is not unprecedented in the Canadian crypto market. Earlier this year, Crypto.com also delisted USDT for Canadian users following a ban by the Ontario Securities Commission (OSC) in 2021. However, the OSC never provided an explanation for the ban.

The Canadian Securities Administrators (CSA) issued a notice on February 22, requiring registered or pending registration crypto exchanges to sign legally binding undertakings with the regulatory body. One of the requirements mentioned in the undertaking is the prohibition of clients buying or depositing Value-Referenced Crypto Assets (stablecoins) through crypto contracts without prior written consent from the CSA.

Tether is known as a stablecoin backed by fiat reserves. DAI operates as a hybrid stablecoin, combining elements of fiat and algorithmic stability. RAI, on the other hand, is an algorithmic stablecoin not tied to any specific asset. Currently, the only CSA-approved stablecoin for centralized crypto exchange listings is USDC (USD Coin).

Other Exchanges Impacted by Regulations

In compliance with the new regulations, OKX withdrew from the Canadian market in June. Similarly, Binance is scheduled to follow suit and withdraw from the Canadian market by September. These regulatory changes have significantly impacted the operations of cryptocurrency exchanges in Canada.

Conclusion

The suspension of trading for Tether, DAI, and RAI stablecoins by Coinbase for Canadian users highlights the increasing regulatory scrutiny on stablecoins in the country. As exchanges navigate the evolving landscape, compliance with CSA regulations is becoming paramount.

Magazine: Should we ban ransomware payments? It’s an attractive but dangerous idea

Mind Uncharted Explore. Discover. Learn.

Mind Uncharted Explore. Discover. Learn.