Aditya Birla Fashion and Retail Limited Share Price Analysis

It hasn’t been the best quarter for Aditya Birla Fashion and Retail Limited (NSE:ABFRL) shareholders, since the share price has fallen 20% in that time. But the silver lining is the stock is up over five years. However we are not very impressed because the share price is only up 15%, less than the market return of 164%.

Although Aditya Birla Fashion and Retail has shed ₹13b from its market cap this week, let’s take a look at its longer term fundamental trends and see if they’ve driven returns.

View our latest analysis for Aditya Birla Fashion and Retail

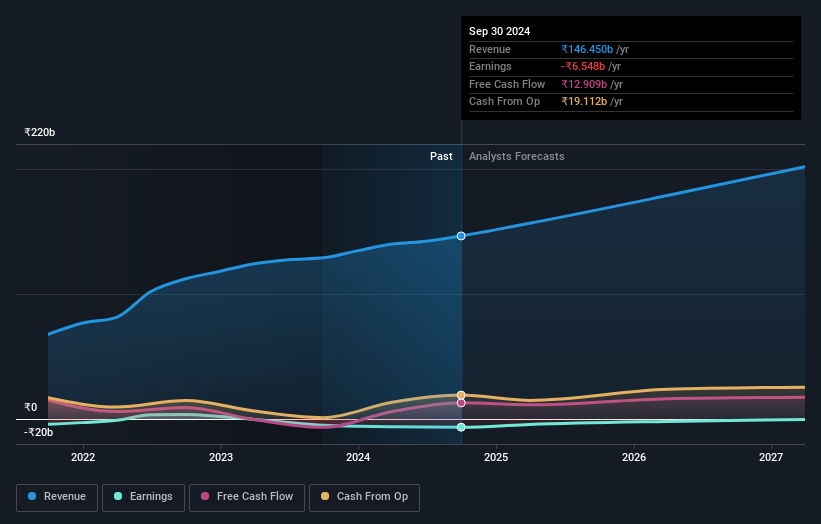

Aditya Birla Fashion and Retail isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Aditya Birla Fashion and Retail saw its revenue grow at 18% per year. That’s well above most pre-profit companies. It’s nice to see shareholders have made a profit, but the gain of 3% over the period isn’t that impressive compared to the overall market. That’s surprising given the strong revenue growth. Arguably this falls in a potential sweet spot – modest share price gains but good top line growth over the long term justifies investigation, in our book.

Aditya Birla Fashion and Retail is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Aditya Birla Fashion and Retail provided a TSR of 15% over the last twelve months. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 3% per year over five years. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we’ve spotted with Aditya Birla Fashion and Retail .

We will like Aditya Birla Fashion and Retail better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Mind Uncharted Explore. Discover. Learn.

Mind Uncharted Explore. Discover. Learn.