China’s Security-Centered Strategy Will Hurt Its Economy More than the US

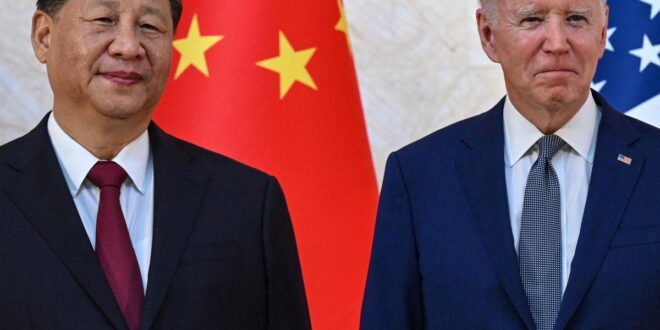

Saul Loeb/AFP via Getty Images

In a Bloomberg Opinion column, Claremont McKenna College professor Minxin Pei suggests that China’s recent ban on the US semiconductor producer Micron and the US Inflation Reduction Act’s effort to exclude some Chinese green energy products indicate that Presidents Xi Jinping and Joe Biden are both putting national security above the economy. However, China’s economy will suffer more, thwarting Beijing’s effort to catch up to the US, Pei adds.

Xi’s Risky Bet

Pei writes that Xi may be betting that US growth will suffer too, but losing access to US technology and markets will likely weigh on China’s growth. With China’s rate of growth expected to outpace the US, the hope is that the country will eventually catch up to its rival. However, Pei predicts that the costs of a security-centered development strategy are likely to be much higher for China than for the US, thus depressing its growth potential and thwarting its ambition to catch up to the US.

China’s Economic Defenses

As private investment has only risen 0.4% so far in 2023 due to investors’ awareness that Beijing is putting security above the economy, China’s “obsession with security” will make it harder for foreign companies to do business in the country, Pei warns. He notes that firms are being investigated for potentially breaking security regulations, while an updated espionage law makes operating in China much more intimidating.

Outlook for China’s Economy

Pei warns that Chinese actions to strengthen its economic defenses will likely be far more costly than their US equivalents, hurting China substantially more than the US. And with previous expectations of a strong Chinese post-Covid rebound seeming misguided as demand and manufacturing output fizzles out, Beijing’s ambitions to catch up to the US will be thwarted.

Conclusion

Pei concludes that both Beijing and Washington seem confident that they can win with a strategy of economic attrition. However, given that one of them has to be wrong, the scholar suggests it is likely China that is in the wrong.

Read the original article on Business Insider

Mind Uncharted Explore. Discover. Learn.

Mind Uncharted Explore. Discover. Learn.