Is accesso Technology Group Still Undervalued?

accesso Technology Group plc (LON:ACSO) may not be a large cap stock, but it has experienced a double-digit share price increase of over 10% in the past couple of months on the AIM. This makes it a less-covered small cap stock, which can present an opportunity for mispricing due to the lack of available information to the public. So, could the stock still be trading at a low price relative to its actual value? Let’s examine accesso Technology Group’s outlook and value based on the most recent financial data to see if the opportunity still exists.

The Opportunity In accesso Technology Group

Good news for investors! accesso Technology Group is currently undervalued. According to my valuation, the intrinsic value for the stock is £10.44, but it is currently trading at UK£7.35 on the share market. This means that there is still an opportunity to buy now. Furthermore, accesso Technology Group’s share price is quite volatile, which provides more chances to buy as the stock could potentially sink lower or rise higher in the future. This volatility is indicated by its high beta, which measures how much the stock moves relative to the rest of the market.

The Growth Potential of accesso Technology Group

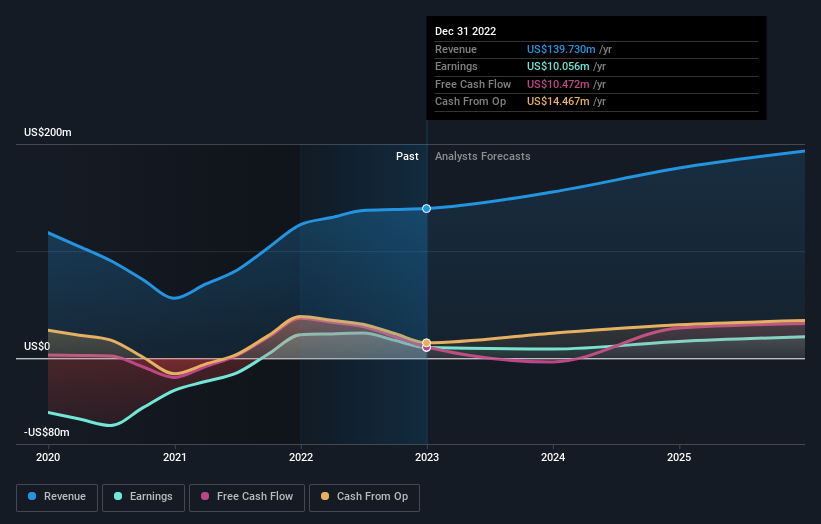

When considering buying a stock, future outlook is an important factor to consider, especially for investors seeking growth in their portfolio. Buying a promising company with a strong outlook at a discounted price is always a smart investment. Therefore, let’s also assess the future expectations for accesso Technology Group. With profit expected to grow by 100% over the next couple of years, the future looks bright for the company. This growth is anticipated to lead to higher cash flow, which should result in a higher share valuation.

What This Means For Shareholders

If you are a shareholder of accesso Technology Group, now is a great time to accumulate more holdings in the stock. Since ACSO is currently undervalued, its positive outlook suggests that this growth potential has not yet been fully reflected in the share price. However, it’s important to consider other factors such as the financial health of the company, which may explain the current undervaluation.

What This Means For Potential Investors

If you have been monitoring accesso Technology Group and considering an investment, now might be the right time to make a move. The company’s promising future outlook hasn’t been fully priced into the stock yet, making it a potentially lucrative opportunity. However, before making any investment decisions, it is advisable to also evaluate other factors such as the track record of the management team.

Risks to Consider

If you want a deeper understanding of accesso Technology Group, it’s important to assess the risks the company currently faces. For more information, you can review the 1 warning sign that we have identified.

Alternative Investment Opportunities

If accesso Technology Group is not of interest to you, our free platform offers a list of over 50 other stocks with a high growth potential that you may want to explore.

Final Thoughts and Disclaimer

Please note that this article from Simply Wall St is based on historical data and analyst forecasts, using an unbiased methodology. It is not intended to be financial advice and does not constitute a recommendation to buy or sell any stock. Your personal objectives and financial situation should be taken into account before making any investment decisions. Simply Wall St aims to provide long-term focused analysis driven by fundamental data. However, it may not incorporate the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. For concerns or feedback on this article, please get in touch with us directly or email editorial-team (at) simplywallst.com.

Participate in a Paid User Research Session

By joining a paid user research session, you can contribute your time and opinion to help us build better investing tools for individual investors. You will receive a US$30 Amazon Gift card for 1 hour of your participation. Sign up here.

Mind Uncharted Explore. Discover. Learn.

Mind Uncharted Explore. Discover. Learn.