MACOM Technology Solutions Holdings’ Stock Performance

MACOM Technology Solutions Holdings’ (NASDAQ:MTSI) stock has increased by 21% over the past three months. The key financial indicators were analyzed to determine if they influenced this price movement.

Understanding Return on Equity (ROE)

Return on Equity (ROE) evaluates a company’s effectiveness in growing its value and managing investors’ money. It assesses profitability in relation to equity capital.

ROE Calculation for MACOM Technology Solutions Holdings

ROE = Net Profit (from continuing operations) ÷ Shareholders’ Equity

MACOM Technology Solutions Holdings’ ROE is calculated as 6.8%.

Relationship Between ROE and Earnings Growth

ROE reflects profitability, while earnings growth potential is influenced by profit retention. A higher ROE and profit retention imply faster growth compared to other companies.

MACOM Technology Solutions Holdings’ Earnings Growth Analysis

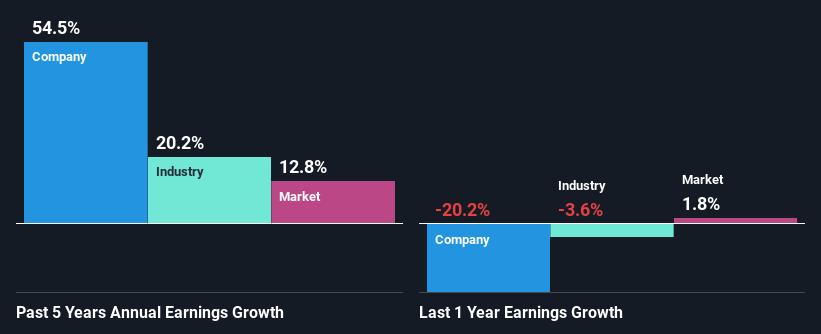

Despite a ROE lower than the industry average, MACOM Technology Solutions Holdings experienced a significant 54% net income growth in the past five years. This growth surpasses the industry average of 20%.

Assessing Valuation and Investment Potential

Earnings growth impacts stock valuation. Understanding if expected growth is factored in helps investors gauge a company’s future prospects.

Reinvestment of Profits

MACOM Technology Solutions Holdings reinvests all profits, leading to high earnings growth.

Final Thoughts on MACOM Technology Solutions Holdings

Despite low ROE, reinvestment strategy contributed to high earnings growth. Analyst forecasts suggest a potential slowdown in earnings growth.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content?

Get in touch

with us directly.

Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mind Uncharted Explore. Discover. Learn.

Mind Uncharted Explore. Discover. Learn.